- Armor Blog

- Trends

- Middle East Lubricants Market Trends And What They Mean For Your Business

Ongoing growth of the Middle East lubricants market

While the Middle East lubricants market is relatively young in comparison with other global industry markets, it is experiencing significant, ongoing growth. In fact, this market alone is expected to grow by 2% between 2019 and 2024, and by 6.5% between 2019 and 2026, with a projected value of USD 2.14 billion. What does this mean for the industry and for businesses within the Middle East?

Growth Drivers Throughout the Middle East Lubricants Market

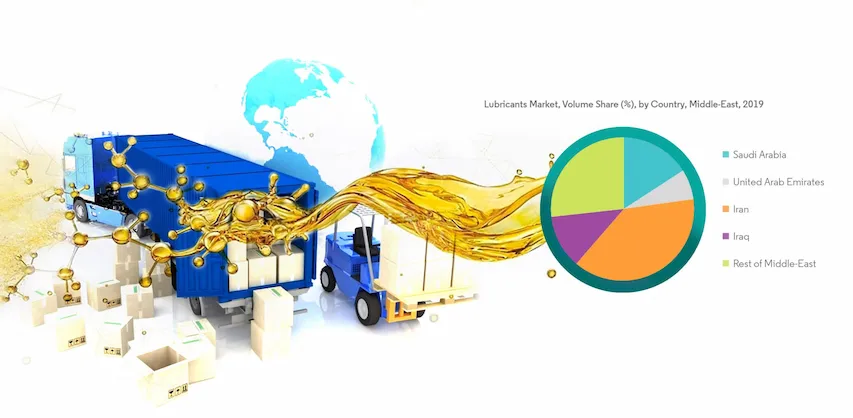

There are many drivers of growth throughout the Middle East, but the largest can be found in the industrial segment within Saudi Arabia, the UAE, and Iran. In addition to industrial lubricants, engine oil is expected to continue increasing due to the demand for high-performance automotive lubricants, including semi-synthetics and full-synthetic blends.

Engine Oils

Engine oil is expected to occupy the largest market share due to a wide range of reasons, including the following:

- Newer formulations, particularly those developed by the trusted manufacturers, offer improved wear reduction, corrosion protection, and operation maintenance.

- Advanced formulations specific to high-mileage engines offer improved performance, as well as the ability to reduce or prevent burn-off and to reduce or eliminate engine oil leaks. These capabilities ensure that vehicles can be driven for longer periods, and that engines last longer even under harsh climatic and use conditions.

- The average age of consumer vehicles in use on the roads has been increasing steadily, and the advances in lubricant oil formulations and additive quality ensure that they are able to be driven safely.

- Synthetic engine oil and new additives are being developed to help address the need to reduce emissions.

- While many consumers are driving their cars for longer periods, many focuses on buying high-end, performance vehicles that demand very specific oil formulations to protect against intense heat during use.

- New automotive gearbox designs, such as CVTs, manually actuated automatics, and multi-gear automatics, require specialized fluids developed for their use, maintenance, and protection.

Additional Oil Demands

While the automotive industry is the single most important driving factor in the industry, there are others that should be understood. One of those is the growth of the metal working industry, which requires very specific lubricants and other fluids for purposes such as grinding and stamping. The growth of power grids within the Middle East is also driving the growth of the finished lubricants market, as power transmission technology requires specialized fluids.

What Does This Mean for Your Lubricants Business in Middle East?

The ongoing growth of the Middle East lubricants market has several different impacts for businesses within the region. One of those is an increase in the competition for your business. As more local companies begin manufacturing oil and other lubricants, they compete with established lubricant companies, such as Shell, Fuchs, Armor and others.

Conclusion

The immediate upshot of this is that you have more options than ever, and the ability to shop around and find the best lubricant products for your needs, whether that’s maintaining a personal vehicle, a fleet of business vehicles, or watercraft.

Armor Lubricants has well established itself as the best lubricant manufacturer in the UAE, achieving significant milestones in product innovation, customer service and support , and market leadership. Celebrating 12 years of achievements, Armor Lubricants is poised for continued growth and innovation in the years to come.

Spear Lubricants

Spear Lubricants Armada lubricant

Armada lubricant Ace lubricants

Ace lubricants Perfect lubricants

Perfect lubricants Enzo lubricants

Enzo lubricants Lawrence lubricants

Lawrence lubricants